Key Considerations for Working With a Family Office

- Many ultra high net worth families can benefit from access to the comprehensive wealth management services offered by family offices—including preservation of wealth across generations, family governance and education, oversight of sophisticated investments, tax and estate planning, accounting, philanthropy, and other lifestyle needs.

- The services family offices deliver can be accessed by creating a single family office, working with a multi-family office through a financial services firm, or engaging outsourced family office offerings tailored to specific needs.

- Successful family offices have established communication frameworks, clearly defined benchmarks for success, clear roles and responsibilities, and capabilities and specialists that scale to match needs.

Why might you consider the services delivered by a family office?

The services family offices deliver can be highly customizable, and the catalyst for working with one is often as unique as the family it serves. Some of the common drivers include (but are not limited to) a large influx of wealth (such as through an IPO or inheritance), securing continuity of financial management and the family legacy across generations, managing complex and time-consuming lifestyle and financial needs, a change or retirement among a family’s existing advisors, or separating family finances from a family business.

Whatever the originating event, we believe accessing family office services can help achieve long-term objectives, such as:

- Establishing and maintaining a cohesive framework for family governance practices and management of the family's wealth across multiple generations

- Creating holistic oversight and continuity of advisory and administrative services, including disparate advisor relationships, accounts, and investments; comprehensive risk management; regular aggregated reporting; philanthropic endeavors; and management of day-to-day responsibilities

- Accessing preferential investments and reduced fees based on large assets under management

- Enhancing confidentiality and privacy

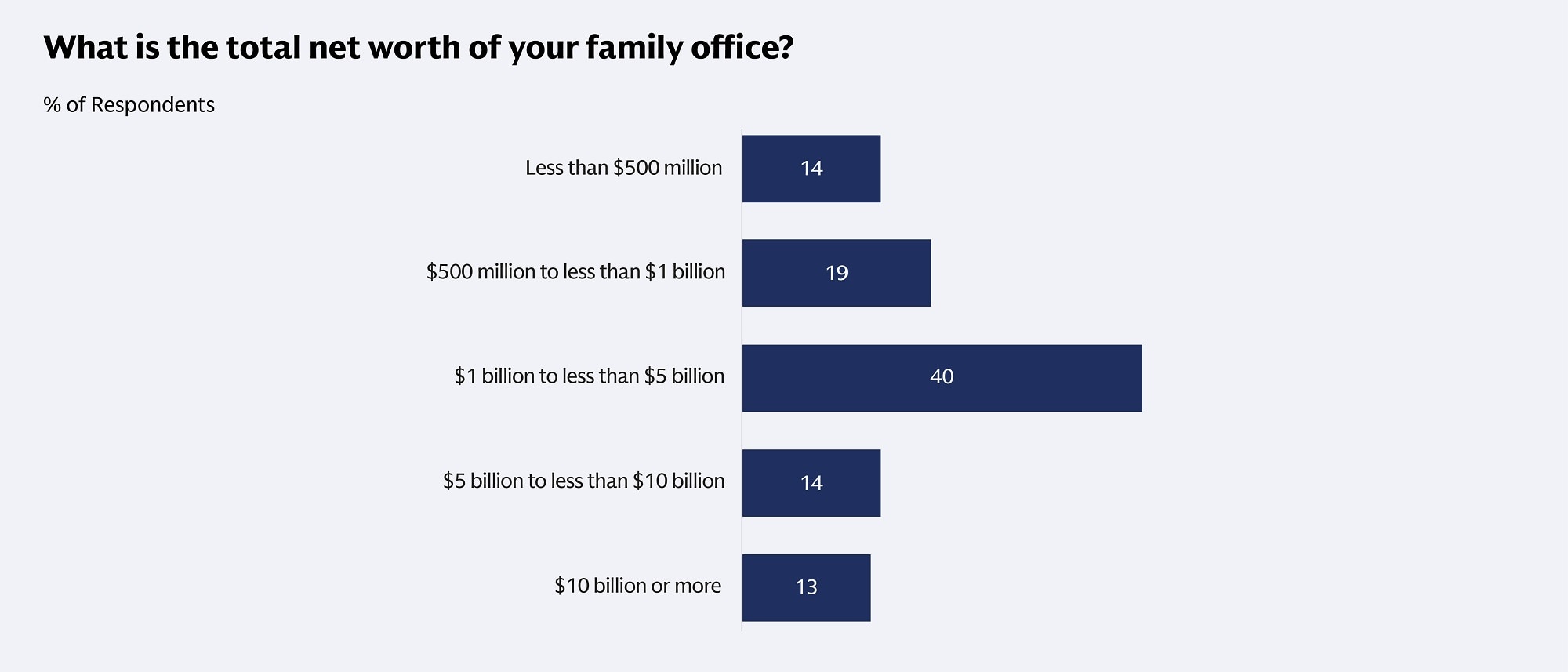

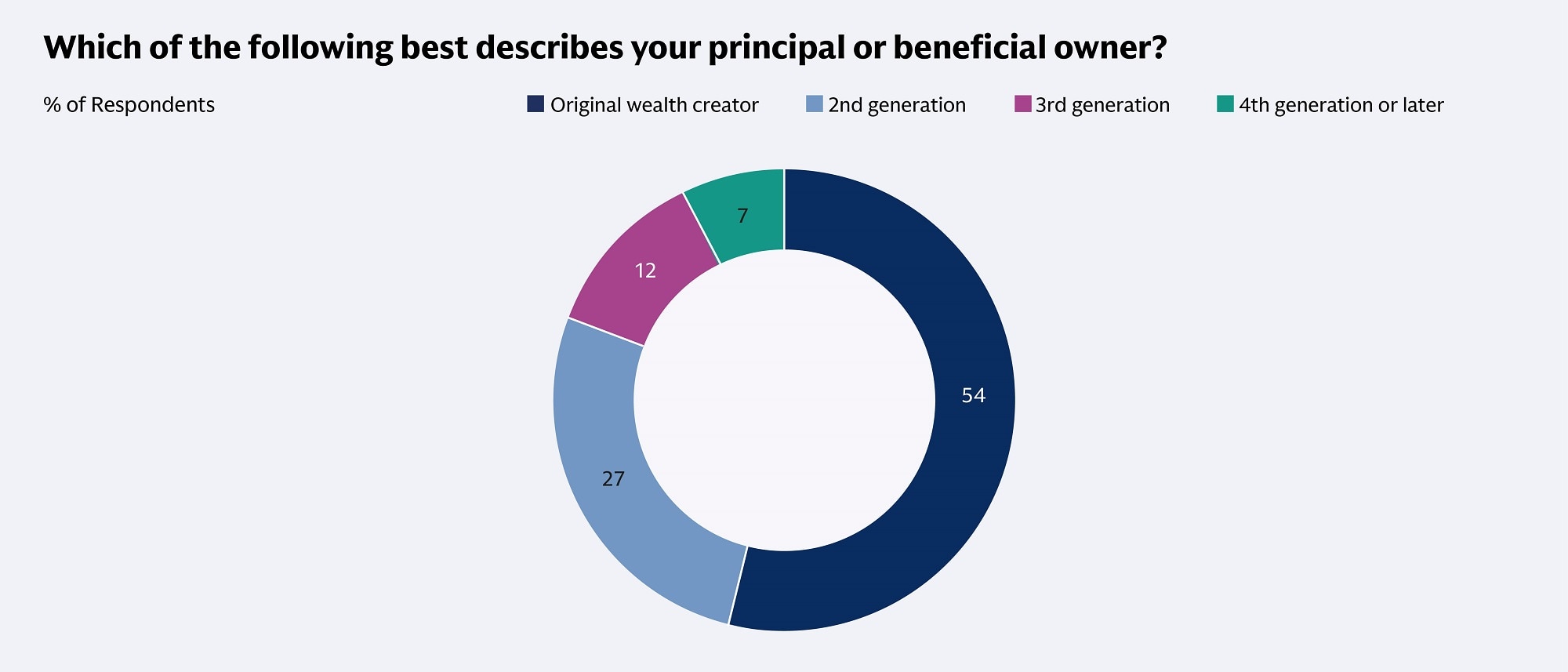

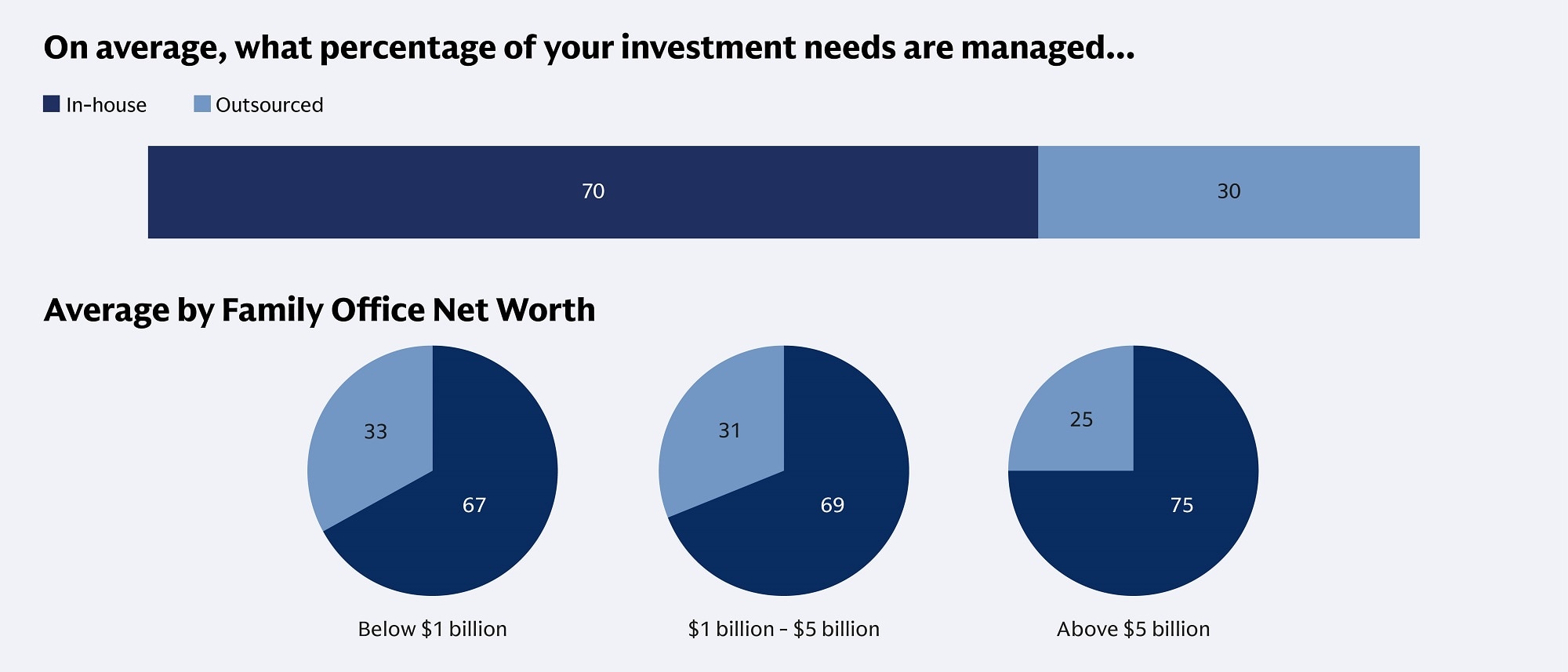

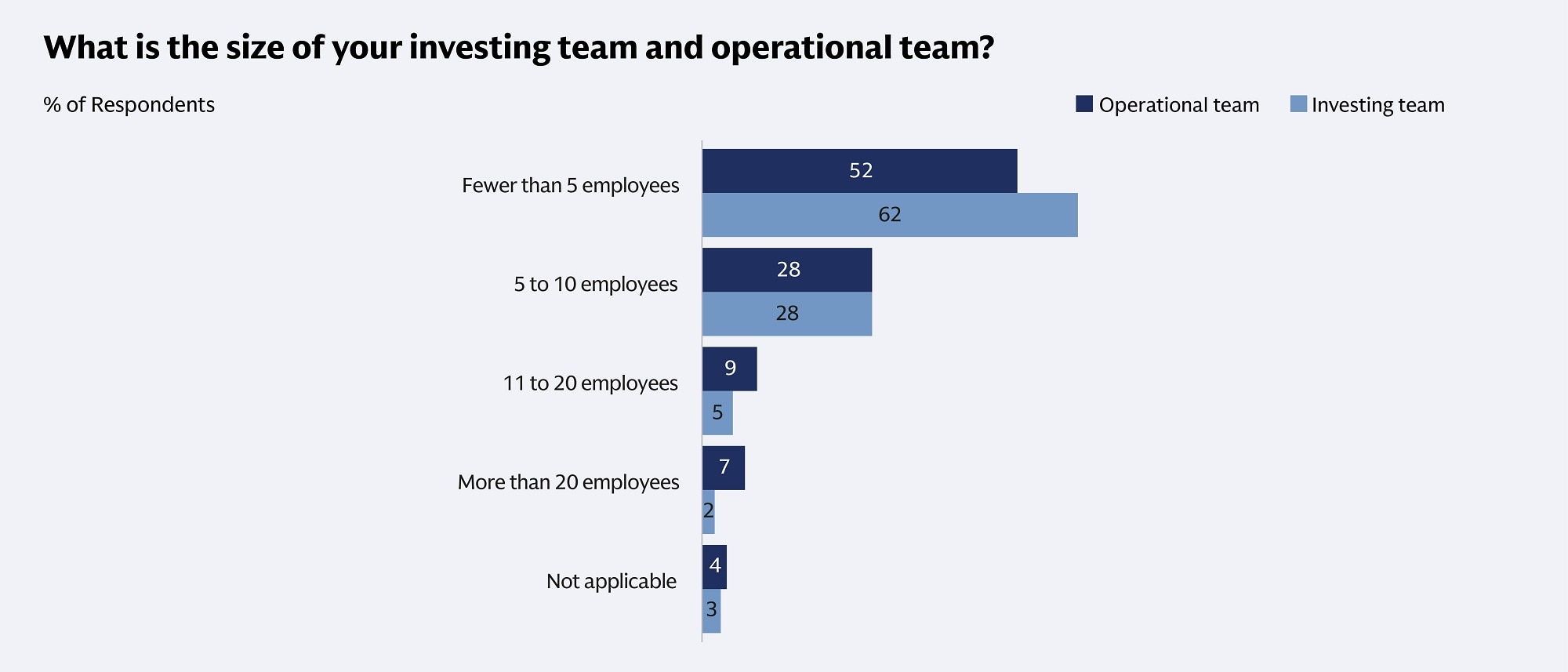

However, starting your own family office comes with significant considerations— including but not limited to potentially higher costs, possible gaps in in-house experience, and reduced access to investment managers—compared to external family office structures. While there are no specific guidelines for when a dedicated family office should be engaged, our 2025 biennial survey of 245 decision-makers at single family offices, whose asset bases are in line with other institutional investors, offers some insight into the structure and asset allocation of family offices.

What family office services and structures should you consider?

Family office services can be classified into three areas:

Wealth planning

Taxplanning and preparation

Philanthropy

Risk management

Family governance and education

Estate and legacy planning

Financial administration

Expense management

Reporting and record keeping

Lifestyle needs (real estate, private plane, art, etc) and concierge services

Office management

Bill pay

Asset allocation

Portfolio management

Manager selection and diligence

Private investments

Custody

Trust management

Preserving wealth across generations and continuity are particularly key focus areas, given research shows 70% of families do not retain wealth into the second generation.¹ “When we talk to our clients about whether or not to work with a family office, three themes stand out: strong governance, flexibility to meet the needs of the extended family, and continuity,” said John Mallory, co-head of global Private Wealth Management.

Across the globe, more than 8,000 family offices collectively manage more than $5.5 trillion.² Their structures largely fall into two categories:

- Single family offices are private entities established by a family to manage their affairs.

- A multi-family office, such as the Goldman Sachs Private Family Office, provides the same type of service as a single family office, but they independently support more than one family and are typically part of a larger financial institution—which can provide certain benefits and efficiencies.

Outsourced family office services, accessed through a private wealth manager or professional services provider, offer a third option. Interest in these services leveraging digital capabilities has increased in recent years as software companies and service providers made significant investments to address the unique demands of UHNW families.³ New offerings are now available for consolidated reporting of alternative investments, accounting, cyber security, and more—all with lower barriers to entry and ongoing overhead than starting a single family office.

The benefits and considerations for each of these structures can help you determine which may best suit your family:

- Family has full control

- Customized services, including personal needs like project managing a startup or running family reunions

- Deep bench of subject matter specialists including in finance, law, taxes, and technology

- Multigenerational model and established continuity

- Experienced investment professionals backed by a large institution

- Low startup and operating costs

- Advanced technology and infrastructure

- Flexibility to scale according to needs

- Reduced ongoing costs

- Targeted out of the box solutions can be independently engaged without need to create separate legal entity

- Intensive startup process and maintenance

- Potential for significant cost

- Employment legal and logistic requirements

- Challenges building sufficient in-house subject matter experience such as sophisticated portfolio analysis or tax efficiency

- Key person risk and succession planning for long-term management

- Often need to work with larger financial institutions to access sophisticated investment opportunities and other services

- Reduced physical oversight by family

- Potential for cultural conflict

- Personnel and resources are shared with other families

- Increased burden of coordinating disparate providers

- Increased due diligence requirements

- Ramp up period as resources scale to meet needs

As you think about the make-up of a family office team, keep in mind how the emergence of AI tools may increase the efficiency of certain functions. More than half of the family offices in our survey are using AI in the investment process, another 42% are interested in using it in the future, and large majorities are using AI for data analytics and insights, research, and automating manual tasks.

What do successful family offices have in common?

Across multiple decades serving UHNW families, our wealth professionals and multi family office team have seen several common strategies that help meet client objectives. Below are some of the key decision points for families looking to effectively engage with family office services:

- Choose the proper structure to meet family goals (e.g., single, multi-family, our outsourced), including necessary technology infrastructure, capabilities/experience, investment manager access, and cost structure.

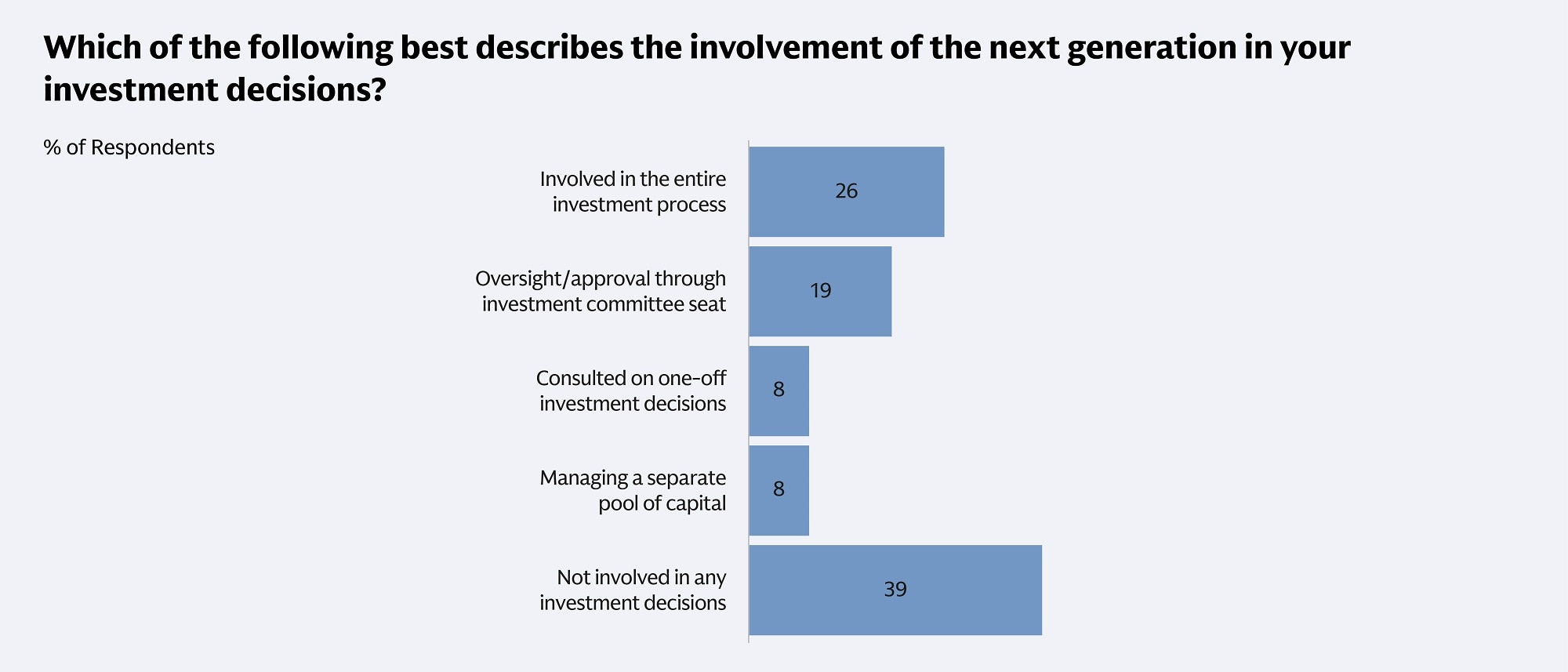

- Create a communications framework between family members and wealth professionals with clearly defined benchmarks for success, a reporting framework, strategies to involve younger generations, and ongoing reviews of the governance structure.

- Define investment objectives at inception and establish investment management oversight.

- Scale capabilities to match needs as they arise, particularly if family offices expect to increase their asset allocations to private equity.

If you’re interested in learning more about family office services, schedule time to speak with a Private Wealth advisor. Goldman Sachs offers a full range of family office services to meet the needs of UHNW families, including The Goldman Sachs Family Office—who deliver both multi family office and outsourced solutions— and the Apex Family Office Coverage team, who work with single family offices to deliver advice, investment solutions, and access to our firm’s full resources.

¹ Professional Wealth Management, Engaging with the Next Generation of Family Wealth, 2024

² Deloitte, Defining the Family Office Landscape, 2024

³ Institutional Investor, The Family Office of Tomorrow, 2024

This material is intended for educational purposes only and is provided solely on the basis that it will not constitute investment advice and will not form a primary basis for any personal or plan’s investment decisions. While it is based on information believed to be reliable, no warranty is given as to its accuracy or completeness and it should not be relied upon as such.

Our Relationship with Clients. Goldman Sachs & Co. LLC (“we,” “us,” and “GS&Co.,” and together with its affiliates, “Goldman Sachs” or “GS”) is registered with the Securities and Exchange Commission (“SEC”) as both a broker-dealer and an investment adviser and is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). We predominantly offer investment advisory and brokerage services to retail investors through our Wealth Management business unit, which includes Private Wealth Management (“PWM”). How we are compensated by you may change over time and will depend on various factors. Please ask questions and review the GS&Co. Form CRS and GS&Co. Relationship Guide/Regulation Best Interest disclosures (available at: https://www.goldmansachs.com/disclosures/ customer-relationship-summary-form-crs/index.html) for important information, including the difference between advisory and brokerage accounts, compensation, fees, conflicts of interest, and our obligations to you. We are part of a full-service, integrated investment banking, investment management, and brokerage firm. Other firm businesses may implement investment strategies that are different from the strategies used or recommended for your portfolio.

Intended Audience. This material is generally intended for clients of PWM and/or prospective clients who would meet the eligibility requirements to be clients of PWM. If you have any questions on whether this material is intended for you, please contact your PWM Team. Materials that discuss advisory services are generally intended for individuals who are Qualified Clients as defined under Rule 305-3 of the Investment Advisers Act of 1940. Materials that discuss alternative investment products are generally intended for recipients who qualify as Accredited Investors as defined in the Securities Act of 1933. GS&Co. considers client suitability, eligibility, and sophistication when distributing marketing materials; not all materials are appropriate for all GS clients. Distribution is premised on the reasonable belief that the recipient has sufficient financial expertise and/or access to resources to independently analyze the information presented. If you do not believe you meet these criteria, please disregard and contact your PWM Team.

GS&Co. and its present and future affiliates may offer and provide through the GS Family Office (“GSFO”) offering—or through a client referral to third parties—a suite of personal family office services (“GSFO Services”) specifically designed for certain Wealth Management clients of GS. As part of GSFO Services, GSFO may discuss with you various aspects of financial planning, including but not necessarily limited to the potential income tax consequences of your investments, estate planning, philanthropic endeavors, and certain other activities that may affect your income tax, gift tax and estate tax. GSFO Services vary among clients, are provided based on individual client needs and preferences, and are generally limited to educational consultations that should not be viewed as tax or legal advice. GSFO does not provide investment advice, investment management services, or advise on or offer the sale of insurance products. GSFO Services are offered in the United States through GS&Co. but may also be provided in part by Goldman Sachs Wealth Services. Goldman Sachs Wealth Services may, separately and distinctly from GSFO Services, provide tax and insurance advice in addition to personal family office services through its Private Family Office. We encourage you to clearly establish your set of services with your advisory team.

Articles were commissioned and approved by GS, but may not reflect the institutional opinions of The Goldman Sachs Group, Inc., Goldman Sachs Bank USA or any of their affiliates, subsidiaries or divisions. GS has no obligation to provide any updates or changes to this data. Information is subject to change without notice.

GS does not provide legal, tax, or accounting advice to its clients, unless explicitly agreed in writing. You are encouraged to consult with your own tax, legal or other professional advisers regarding your specific circumstances.

No Distribution; No Offer or Solicitation. This material may not, without GS‘s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient. This material is not an offer or solicitation with respect to the purchase or sale of any security in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation.

© 2025 Goldman Sachs. All rights reserved.

Goldman Sachs & Co. LLC is registered with the Securities and Exchange Commission (“SEC”) as both a broker-dealer and an investment adviser and is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”).